Standard Investments

Standard Investments is a fundamentally-driven investment platform focused on the intersection of industry and technology. We deploy capital flexibly and creatively across the public and private markets, spanning the life cycle of a company. We leverage our deep industrial knowledge and operational experience to create value.

Our flexible approach allows us to invest across sectors and growth stages and can span the life cycle of a company.

-

Public Equities

Our multi-billion dollar portfolio relies on fundamental analysis to take a concentrated, long-term approach to public market investing.

-

Venture Capital

PortfolioWe invest in early-to-growth stage companies that leverage data, technology advances and business models to shape the industrial future. Our portfolio generally includes investments in manufacturing, digital technologies, transportation and mobility, sustainability and the built environment.

-

Media

PortfolioWe invest in companies with innovative and disruptive business models that seek to transform the way stories are told, enabling them to reach greater audiences and deliver compelling content.

Our Team

David Millstone

Co-CIO of Standard Investments

David J. Millstone is co-Chief Executive Officer of Standard Industries, a privately-held, global industrial company with businesses spanning building solutions and specialty chemicals and annual revenues of approximately $11 billion. Across its platform, Standard has over 20,000 employees in approximately 50 countries. Through its related investment platform, Standard Investments, and real estate arm, Winter Properties, Standard also manages a broad portfolio that spans public equities, venture capital and real estate.

Mr. Millstone is a graduate of Yale College and Harvard Law School and currently serves on the Board of Advisors of the Harvard Law School Program on Corporate Governance. With his wife, Jennifer, he is active in supporting a number of civic organizations, including the 92nd Street Y, the Fortune Society and the Bard Prison Initiative.

David Winter

Co-CIO of Standard Investments

David S. Winter is co-Chief Executive Officer of Standard Industries, a privately-held, global industrial company with businesses spanning building solutions and specialty chemicals and annual revenues of approximately $11 billion. Across its platform, Standard has over 20,000 employees in approximately 50 countries. Through its related investment platform, Standard Investments, and real estate arm, Winter Properties, Standard also manages a broad portfolio that spans public equities, venture capital and real estate.

Mr. Winter is involved in various civic and charitable endeavors, including serving on the Board of Directors of Conservation International and on the Board of Trustees for The Metropolitan Museum of Art and Carnegie Hall. He is also a Trustee of the New York City Police Foundation and on the Board of Directors of the Partnership for New York City.

Ethan Leidinger

Mr. Leidinger is involved with all aspects of the day-to-day operations of Standard Investments. Before joining Standard, Mr. Leidinger was the Director of Investor Relations and Business Development at Woodbine Capital Advisors, Director of Investor Relations at Select Equity Group, and a Vice President in the Alternative Capital Markets Group at Goldman Sachs. Prior to business school, Mr. Leidinger was the US Product Manager for Goldman Sachs Asset Management’s Quantitative Strategies Group. Mr. Leidinger earned his MBA from the Stanford Graduate School of Business and graduated from Princeton University’s Woodrow Wilson School of Public and International Affairs.

Tunde Reddy

Ms. Reddy oversees all financial matters at Standard Investments. Before joining Standard, Ms. Reddy was a Managing Director and Head of GSAM Fund Controllers for the Americas at Goldman Sachs, Managing Director and Head of Fund and Portfolio Administration for the Americas at J.P. Morgan, and Manager and Lead Controller for Morgan Stanley in the Real Estate Fund Group. She started her career in the Financial Services Audit and Business Advisory Group at Andersen Worldwide.

Michael Bonnici

Valentina Cassata

Jennifer Chai

Roberto Chorro

Sam Chowdhury

Jay Dickenson

Tara Finelli

Stephen Fisch

Sean Fletcher

Jeff Hare

Julia Klein

Drew Kriens

Peter Marturano

Nick McCormack

Jean Paciullo

Matt Pavia

Carmine Rossetti

Ben Sampson

Marianne Wu

Kangping Yu

Howard Zauderer

Ross Zhang

In the News

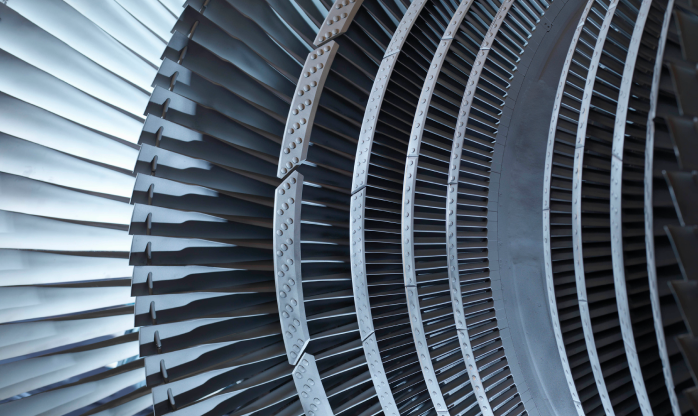

Proterra Secures $200M Investment from Cowen Sustainable Advisors, Soros Fund Management, Generation Investment Management, and Broadscale Group

Generac Accelerates Its Energy Technology Capabilities With Acquisition of Enbala Power Networks

Desktop Metal to Become Public, Creating the Only Listed Pure-Play Additive Manufacturing 2.0 Company

Bustech Selects Proterra Powered™ as Battery Technology Supplier for New Electric Transit Bus in Australia

40 North Ventures Acquires Investments in Eleven Companies from GE Ventures, Reinforcing Its Commitment to Transform the Industrial Sector

ETS Unveils Fleet of Proterra Electric Buses

Giant Food Partners with Volta to Provide Free-to-Use Electric Vehicle Charging Stations

Ohio DOT Launches Pilot Using Nexar Dash Cams to Improve Workzone Safety

John Zink Reports Positive Results with Desktop Metal Studio System

Menlo Micro – How RF MEMS Tech Finally Delivered the “Ideal Switch”

Aras Announces Digital Twin Core for Creating and Managing Digital Twins

Nexar Announces $52 Million Series C Amid Rapid U.S. Growth, Launches On-Demand Data Product To Support Public Response To COVID-19

To view Standard Investments’ Form ADV Part 3 (Form CRS), click here.